Simple and Easy Way to Bank, Anytime, Anywhere!

Meezan Internet Banking is the complete way to bank whenever and wherever you may be. Simply enjoy the finest banking experience from the comfort of your own home or office.

Login Now Register

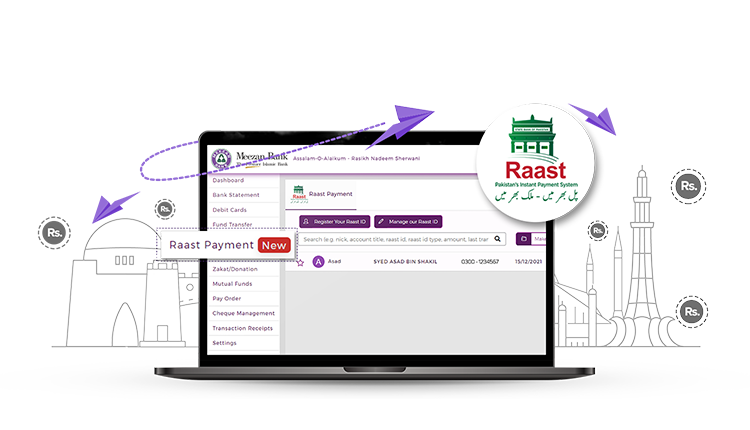

Raast is Pakistan’s first instant payment system that aims to improve payment infrastructure, with the objective of further developing the digital financial services, reducing reliance on cash, and driving financial inclusion in the country. It will enable individuals, businesses, and government entities to make any payment digitally in a simple, fast, low-cost, and secure manner.

With Raast ID registration, your mobile number is now your account number.

Steps to Register Raast ID

All Your Banking Needs on Your fingertips

Packed with smart features, Meezan Mobile App provides secure, on-the-go access to your accounts with built-in powerful and intuitive tools for managing them.

Banking should be simple, quick and convenient and that is the idea behind the Meezan Mobile Banking App.

Key Features:

Meezan Bank launches WhatsApp Banking to bring banking at your fingertips. Now you can get your desired information within seconds by simply sending a message on our official WhatsApp number and selecting a relevant option from the menu.

With WhatsApp Banking, our customers only have to save Meezan Bank’s WhatsApp number and get registered. They can then start enquiring and get instant responses without having to visit the website or calling the Call Centre.

Benefits

Services Offered

Disclaimer: WhatsApp Banking services are currently available to all Meezan Bank customers, except for corporate accounts.

Meezan Bank customers can now experience a smarter way to make payments with Google Pay using Meezan Bank Debit Cards. By linking their debit card to Google Wallet, customers can easily manage their bank accounts and cards for quick, convenient payments. With Google Pay customers can make fast, secure transactions wherever it is accepted, with security guaranteed every step of the way.

Making payments in stores is now faster and safer! Just follow these simple steps:

To get started, open the ‘Google Wallet’ App or download it on Google Play on your NFC-enabled Android phone. Then follow these three simple steps to create your digital card:

Now, use your Meezan Bank Debit Card on Google Wallet for fast, secure, and hassle-free payments wherever Google Pay is accepted. With Google Pay, your Meezan Bank Debit Card transactions are always safe. Your actual card number is never shared, ensuring your payment information stays protected every time you tap to pay.

Note: Transactions will be conducted using the default digital card.

Digitize your Meezan Debit Card and make quick payments with the tap of your Android phone in three easy steps:

on the POS machine.

on the POS machine.Login to Meezan Mobile App with your NFC enabled Android phone & follow three simple steps to create your digital card:

After you have followed these three steps, your debit card will be digitized and ready for Tap & Go.

Use Meezan Tap & Go at all your favorite outlets across Pakistan and abroad. Meezan Tap & Go can be used at any merchant with an NFC-enabled POS machine. Pay for your groceries, fuel, or at your favorite restaurants and brands using your smartphone for one-tap checkout!

Note: Transactions will be conducted using the default digital card.

Amidst the surge of digital transactions in Pakistan, Meezan Bank is dedicated to empowering merchants with innovative solutions that enhance their ability to provide faster and more reliable payment options to their customers.

At the heart of this commitment are our state-of- the-art Point-of-Sale (POS) terminals, boasting a multitude of connectivity options. This transformative technology has revolutionized the transaction experience for both merchants and customers, ensuring seamless and faster payments. The Meezan Bank’s POS terminal facility equips merchants to readily accept various cards, including MasterCard, VISA, UnionPay, and PayPak, thus facilitating a comprehensive payment landscape.

Key Features:

In a pioneering move, Meezan Bank takes the lead as the first bank in Pakistan to introduce a 3DS-2 payment platform. Tailored exclusively for e-commerce merchants, this platform empowers them to seamlessly accept online payments from their customers through API integration on mobile applications and websites. The Meezan Payment Gateway accepts all major card schemes, making it a versatile and efficient solution. Additionally, our gateway offers advanced features including Tokenized Transactions, Invoiced Billing, and Recurring Payments, designed to offer merchants with added levels of convenience and flexibility.

Key Features:

To avail this facility, kindly visit your nearest branch or contact us at (021) 111-331-331 and (021) 111-331-332.

Meezan Bank Debit Card customers can now simply ' Tap and Pay ' at payment counters of all NFC enabled merchants across the globe along with additional security of EMV or chip card technology.

Access your money from any location at any time with our range of EMV & NFC enabled Debit Card suited to every type of customer.

Want access to your money anytime, anywhere? With a Meezan Visa Debit Card, you have access to the money in your account wherever you are, whenever you want, wherever you see the Visa symbol. The money is deducted from your balance straight away — there is no interest to pay, no bills & no late fees!

Charges and Benefits

More than just an ATM card, you can use your Meezan Titanium MasterCard Debit Card wherever MasterCard is accepted. Whether you want to pay for fuel, shopping, dining or anything else, you can easily use your Meezan Titanium MasterCard Debit Card to access the funds in your account rather than carrying cash.

Charges and Benefits

The Platinum MasterCard Debit Card opens a world of convenience for customers by giving them access to 2.1 million MasterCard compatible ATMs and 32 million Merchants in Pakistan and around the world. Our customers can shop, dine, travel and refuel whenever they want, wherever they want. Platinum card holders also get free access to International CIP lounges as well as higher withdrawal and POS transaction limits.

Learn MoreThere is something that sets you apart. It is your character – the inner you who dares to dream and chases ambition, pushing you to prosper in every endeavour. Meezan Visa Infinite Debit Card bears testimony to the achievements you have already accomplished and serves as a hallmark of the distinct path you continue to walk.

Learn More

The Meezan World Debit Card offers a world of unparalleled exclusivity and convenience. Unlock a global suite of the finest benefits and privileges designed specifically to complement your preferences. With a host of travel and lifestyle offers coupled with unprecedented spending limits, the Meezan World Debit Card is the perfect companion for the frequent flyer.

Learn MoreIn today’s interconnected world, we recognize the significance of seamless and convenient banking. That is why we are pleased to offer the Meezan Foreign Currency (FCY) Debit Card, which facilitates Pakistani exporters and freelancers holding an ESFCA account by providing unmatched global access to perform swift financial transactions.

Learn More

With supplementary cards, you can off-load the responsibility of providing cash to your loved ones for their day-to-day expenses. Not only this, you can also provide shopping independence and share the benefits of your Meezan Debit Card with your spouse, children, siblings and parents.

Meezan PayPak Debit Card is a PIN based card that ensures utmost security not only at ATM machine for cash withdrawal but also at POS terminal while shopping at all merchant outlets across Pakistan.

Learn MoreMeezan Bank’s Debit Card can now be activated from your nearest Meezan Bank ATM. This quick and simple service has been introduced to allow greater convenience to our valued customers.

To activate your Debit Card, please follow these four simple steps:

Step 1

Collect Debit Card from your Meezan Bank branch

Step 2

Visit your nearest Meezan Bank's ATM and insert your card

Step 3

Enter your Card Activation Code sent to your registered mobile number

Step 4

Set your 4 digit ATM PIN

Meezan Bank Debit Cards can now be used for online shopping securely using Verified by Visa or MasterCard Securecode. Your card is now protected by Verified by Visa (VBV) or MasterCard SecureCode platform for internet-based transactions. This is the latest technology supported by Visa & MasterCard, designed to ensure safe e-commerce transactions through authentication of each transaction by the cardholder so that you can use your card online with more confidence.

With this service, when you use your Debit Card on websites that have incorporated the "Verified by Visa" or “MasterCard Securecode” sign, you will receive a One-Time Passcode (OTP) either by SMS or email to complete your transaction. To avail the benefits of this service, you must ensure that your mobile phone number and/or email address are updated with us.

Get enhanced protection when shopping online on Verified by Visa or MasterCard Securecode enabled websites as each payment requires secondary verification via SMS and/or email.

Make online purchases from many international websites that prefer Verified by Visa or MasterCard Securecode enabled cards.

Enjoy hassle-free online shopping. With the introduction of this service, your Meezan Bank Debit Card is automatically enabled for internet-based transactions.

QuickPay allows you to pay your Utility, ISP and Mobile Phone Bills free of cost anytime, without waiting in queues at the bank’s counter! Meezan QuickPay service is available 24 hours a day 7 days a week via Meezan Bank’s Internet Banking, Mobile Banking App and ATM Network.

Our Bank is available 24/7 for you

With our Call Centre facility, you no longer have to take time out to visit your branch for your everyday banking needs. By simply dialing 111-331-331 or 111-331-332 (dial +92-21-111-331-331 or +92-21-111-331-332 from outside Pakistan) you get access to a wide range of personalized banking services including answers to questions on Islamic Banking. You can also access our self-service banking, where you can access your account details & product information by our Interactive Voice Response System (IVR).

Consumer, ADC & Liability Products Information.

ATM / Debit card activation.*

ATM PIN generation & re-issuance.*

ATM / Debit card blocking.

ATM /Debit card replacement

Account balance confirmation.*

Account transaction details.*

Web-Pay (on-line shopping) activation / de-activation.*

Transfer of Funds b/w your own account.*

Request for Cheque book.

Request for Pay Orders.

Cheque Stop Payment request.

Bank Statement Request.

SMS registration /change & block request*

Request for email update /change.*

Reactivation of Internet Banking.*

Recovery of Password.*

Recovery of User Name.*

Deactivation of Internet Banking services.

IBFT Activation*

Change PIN / TPIN.

Inquire Balance.

Transaction Inquiry.

Product Information.

* Customer Needs To Call From His System Updated Numbers

Enjoy a host of banking services round-the-clock!

Meezan Bank offers a nation-wide network of ATMs located at its branches and prominent offsite locations. There is no need to carry cash anymore; simply go to the ATM and withdraw cash anywhere, anytime. We also offer access to more than 8,000 ATMs country-wide via 1Link and MNET Networks.

Discover the future of banking through the “Every Branch is My Branch” initiative, and embrace a new era of convenient banking.

Your banking options are no longer restricted by your location. You can visit any Meezan Bank branch to access a wide range of our banking services, just as you would at your parent branch.

We ensure secure, swift, and hassle-free transactions to provide you with a seamless and reliable banking experience.

Obtain various banking solutions and services without visiting your parent branch:

![]()

Cash over Counter

![]()

Direct Credit to Meezan Account

![]()

Inter-bank Funds Transfer

![]()

Real Time Gross Settlement (RTGS)

![]()

Instant Credit Facility to Mobile Wallets